Archive

Reaganomics and Welfare

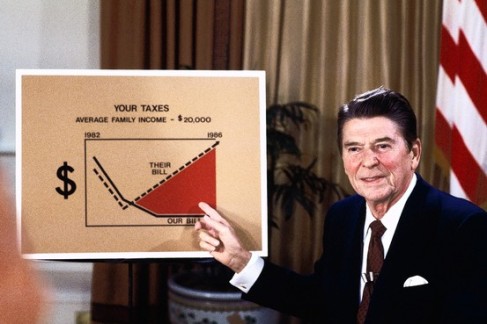

When President Reagan first took office in the early 1981, the country was facing an economic recession. The President and his team worked swiftly to propose plans for economic recovery. As a part of the President’s administration I helped with the planning. We concluded that government spending had to be cut while simultaneously decreasing income taxes. “Reaganomics” would have a trickle down effect: the tax cuts that would benefit the wealthy would trickle down and benefit the poor.

In order to decrease government spending, the President needed to cut funding for unsuccessful programs. Many of the community action programs of the 1960s did not operate as originally intended and some were seen as failures. President Reagan decided to withdraw federal funding for many programs, but “responsibility for efforts such as Aid to Families with Dependent Children and school lunches was shifted to individual states” (PBS). By giving these programs back to the states, each state can mold the programs to fit the needs of their constituents. A federally funded social service program must be the same throughout all states, and might not address all the problems each individual state has. Now, the state governments can address their state’s most important social issues through their own state run programs. Even President Reagan believed that state run programs would be more beneficial: “this will make welfare less costly and more responsive to genuine need because it will be designed and administered closer to the grass roots of people it serves” (Reagan). To avoid any problems, the federal government agreed to fund the programs for ten years during its transition to the state level. This shift to the local level “would save 25 percent in administrative costs” (Roberts).

In order to decrease government spending, the President needed to cut funding for unsuccessful programs. Many of the community action programs of the 1960s did not operate as originally intended and some were seen as failures. President Reagan decided to withdraw federal funding for many programs, but “responsibility for efforts such as Aid to Families with Dependent Children and school lunches was shifted to individual states” (PBS). By giving these programs back to the states, each state can mold the programs to fit the needs of their constituents. A federally funded social service program must be the same throughout all states, and might not address all the problems each individual state has. Now, the state governments can address their state’s most important social issues through their own state run programs. Even President Reagan believed that state run programs would be more beneficial: “this will make welfare less costly and more responsive to genuine need because it will be designed and administered closer to the grass roots of people it serves” (Reagan). To avoid any problems, the federal government agreed to fund the programs for ten years during its transition to the state level. This shift to the local level “would save 25 percent in administrative costs” (Roberts).

In his 1982 State of the Union speech, President Reagan addressed those critics who believed decreasing government spending would hurt the poor. To reiterate his speech, “the federal government will subsidize 95 million meals every day” (Reagan) and will continue funding the Head Start program. Just last year, the federal government announced it would fund the Medicaid program in addition to the Medicare program.

The First Lady has been urging the President to create an anti-drug program. As a result, we have been doing a lot of research on the drug problem in America. Since drugs are a hazard on the community, especially in urban cities, an anti-drug program will only help the community. From the way our research is going, it looks as though we will be drafting program details soon and a will hopefully have the program ready to begin in the next year.

The White House

February 1985

Sources:

“Domestic Politics.” American Experience. PBS. Web. 22 Apr. 2012. <http://www.pbs.org/wgbh/americanexperience/features/general-article/reagan-domestic/>.

Reagan, Ronald. “1982 State of the Union Address.” Address. The Capitol, Washington, DC. Jan. 1982. American Experience. PBS. Web. 20 Apr. 2012. <http://www.pbs.org/wgbh/americanexperience/features/primary-resources/reagan-1982-address/>.

Roberts, Steven V. “FIGHTING OVER BLOCK GRANTS CATCHES STATES IN THE MIDDLE.” The New York Times. The New York Times, 02 Aug. 1981. Web. 16 Apr. 2012. <http://www.nytimes.com/1981/08/02/weekinreview/fighting-over-block-grants-catches-states-in-the-middle.html>.

Photo credit: Getty Images

A Second Generation of Poverty, Under Funded and Marginalized

A Second Generation of Poverty, Under Funded and Marginalized

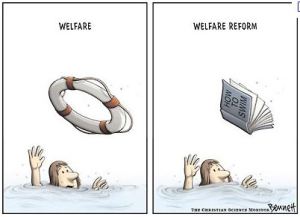

The year is 1985, and I can feel a shift in the way the country is thinking about poverty. It’s been four tough years since the passing of my mother, Gina Tillman. I never expected it to be so hard without her – I guess I never even realized how much she helped me out. All I know is that I have definitely been struggling to make ends meet, and the recent government reforms in welfare and society programs have only made my day-to-day more complicated and harder to manage.

My name is Maya Tillman, and I am a thirty three year old mother of three. You may have had the chance to meet my mother, Gina, a while back when President Johnson was in the process of enacting the Great Society programs in order to help families like mine. She died a couple of years ago from a heart attack – it was sudden. I was not prepared to lose her – she was my support system, providing whatever little money she had to help me raise my kids. Watching her raise me and Johnnie, I always told myself that there was no way I was going to raise my kids without a father, and I was successful for a while. Charles and I had Yvette, our first daughter, together when I was twenty three. The twins, Kenny and Robbie followed just two years later. Although Charles and I never got married, things were going really well for some time. Charles was working part time, and I was bringing in enough from welfare aid to keep us in our small apartment. But two years ago, Charles took a turn for the worse. He got mixed up in drugs, and eventually started using himself. When I saw that this habit was becoming detrimental to our way of life, and especially the lives of my children, I told him to get out. He packed his bags, and I haven’t seen him ever since.

I’m not going to lie – these days we’re struggling. With the recent welfare reforms enacted by President Reagan, I’m seeing less and less income from my welfare checks. My brother Johnnie, the only relative I have inBaltimore, tries to help out as much as he can, but he has his own family to take care of, and I can’t continue relying on him for everything. As I said, I’m getting less and less money every month, and with my kids getting older, the expenses are only growing. This makes me want to ask a question – how much of an obligation does the American society have to take care of its own people?

Ever since President Reagan came to office, we have been hearing about changes to the existing welfare programs, including budget cuts and less intervention from the federal level. My neighbor Lucille Phillips, a mother of seven with whom I currently share our brick rowhouse in West Baltimore, had her first baby in the 1960’s right after quitting the seventh grade at age 14. Because of the recent cuts in welfare funding, Lucille has been looking for her first job at the age of 39. The other day, she told me, “It’s not so easy to get jobs, but I can read and write. I can do pretty good, and I’m not ashamed to ask questions. I’m looking for main or housekeeper work. That’s the best with my education” (McNulty). I think that with many of the welfare programs receiving less funding, competition for jobs will only increase, making it harder for people like Lucille and I to be employed. Another one of the women on my block, Denise Green, a single mother of 3 and the head of her household, doesn’t even have the chance to look for work because she has to stay home in order to look after her children. She is hesitant to leave them with strangers, and “the welfare won’t pay family to watch them” (McNulty). Furthermore, the amount of federal money available for helping people get training and find jobs has been cut significantly during the last four years, and while “Baltimore found summer work for 17,5000 young men and women…this summer we hope to [have] 4,000 working.” Chances seem slim that Lucille, Denise and I will be a part of those four thousand new employees.

It seems like giving the city more flexibility without giving it the financial resources necessary to help those on welfare makes no sense. In 1982, 15.2% of Americans were living below the poverty line, and this number has only been rising during the last several years, with 868,000 more dropping below the line in 1983. I recently heard that the Reagan administration is even considering changing the definition of poverty to include noncash aid given to the poor, “money handed out in food stamps and subsidized housing” (McNulty). If these numbers are to be included in the poverty definition, only 10% of Americans would be considered to be living below the line. It seems like the current mindset of the administration is that “if the poverty levels were lowered by as much as a third, then the government doesn’t need to do as much, and therefore it can afford to spend less on the poor” (McNulty). Just seems like an excuse to reduce welfare aid to me. Politicians keep saying “that people are unemployed because they are not trying hard enough, that the jobs are there if they want them” (McNulty). All I know is that AFDC payments have been reduced by 36% during the last decade, making it harder for me to support my children, especially with my mother and Charles.

I hear many saying that welfare benefits only encourage a lack of responsibility, and that helping the poor is counterproductive, as it creates dependency on the state. But how am I, a single mother of three, supposed to support my children without any family or a husband? This raises not only anger, but also a lot of questions on my part. Is the government against me? Why is funding being cut? Will it really encourage others to go out and look for work, even when there aren’t enough jobs available? Is there a more logical solution to the welfare question? I hope the government changes their policies soon. Without work and a support system of relatives, I really rely on the welfare payments to help me take care of my family and provide for my kids.

– Maya Tillman, single mother on welfare, 1985

Source:

Chicago Tribune, March 17, 1985. Timothy J. McNulty. New Approaches To Poverty Alter Conscience Of Nation.

<http://articles.chicagotribune.com/1985-03-17/news/8501150831_1_poverty-great-society-americans>. (April 18, 2012).

New Federalism, New Problems

While it’s true that the Great Society programs had many flaws, President Reagan’s New Federalism initiatives have done even more harm for nonprofit organizations. As a member of a nonprofit group I was initially very excited to hear about Reagan’s plan. New Federalism promised to return power to the state and local governments, cutting back on the debilitating bureaucratic constraints imposed by the Great Society and allowing for more flexibility and creativity on the ground level.

The reality of New Federalism, however, was very different. Reagan returned power to state and local governments not to increase their creative control or flexibility, but to pass off “administrative, financial and policy-setting responsibility [to] lower levels of government” (Palmer 15). This was a way to cut the size and costs of the federal government at the expense of state and local governments. For instance, federal aid packages that funded social welfare programs and community development organizations were singled out for the sharpest budget cuts. In fact in FY1982, Congress consolidated 77 categorical programs into 9 block grants and from FY 1981-FY 1985 reduced the income available to nonprofits by $35 billion (Palmer 12). These kinds of policies have severely prohibited nonprofits, such as my own, from carrying out our visions. We might have more control over how to spend our money, but this means nothing if we have no money to spend in the first place. As a result of these cuts, the individual recipients of our services and our communities as a whole are suffering. After all, nonprofit organizations play a substantial role in communities. In 1980, nonprofits in the U.S. spent $70 billion on health care, $25.2 billion on education/research and $13.2 billion on social services (Anheier, Seibel 221). Cutting funding for nonprofit groups has had negative effects on individuals, communities and the country as a whole.

To replace the significant cuts in federal funding for nonprofits, the Reagan administration has encouraged nonprofits to increase the number of private contributions they receive. But in order to hold constant the real value of nonprofits, charitable donations between 1983-1985 would have to increase 40% annually. In addition, it doesn’t help that the Reagan administration has changed the federal tax policy to raise the after-tax costs of private donations (Palmer 13). To replace federal funding Reagan is pushing nonprofits into a purely free market system, however these institutions were created to serve not to compete. Today, my organization is forced to spend valuable time fundraising and networking instead of implementing our programs and making a positive difference in our communities.

Not only did the Reagan administration cut funding for nonprofits, but he directly cut many social welfare programs. For example, he reduced extended unemployment benefits, increased patient cost sharing in Medicare and tightened the income eligibility restrictions in school lunch programs (Palmer 17). Overall, fewer people are eligible for programs and those that are still eligible receive fewer benefits. Also, these cuts have primarily affected the low-income families that have the greatest need for such programs.

Reagan’s policies may have advocated for more creativity and flexibility on the state and local levels, but the federal government continues to assert power over nonprofits by restricting their resources. The reality is that the government provides a huge proportion of the funding needed to operate nonprofits. If this funding is not reestablished, nonprofits will be unable to deliver and distribute the services that the government is responsible for providing and that the public desperately needs (Anheier, Seibel 229).

Camilla Seiler, Community Activist

April 17th, 1985

Sources:

Anheier, Helmut K., and Wolfgang Seibel. The Third Sector: Comparative Studies of Nonprofit Organizations. Berlin: Walter De Gruyter, 1990. Print.

Palmer, John Logan, and Isabel V. Sawhill. The Reagan Experiment. Washington, D.C.: Urban Institute, 1982. Print.

Changing Domestic Priorities Project Ser.

Smith, Steven Rathgeb, and Michael Lipsky. Nonprofits for Hire: The Welfare State in the Age of Contracting. Cambridge, MA: Harvard UP, 1993. Print.

Photo:

Steig, William. “Woman writing letter”. September 12, 1988. Web. 18 Apr. 2012. http://www.condenaststore.com/-sp/Dear-President-Reagan-You-know-as-well-as-I-do-New-Yorker-Cartoon-Prints_i8537630_.htm

The Great Society Programs: The Need for a Restructuring

The welfare programs of the Great Society, while admirable, have been a marked failure for the federal government, both in their success rates and in their administration. The federal government bureaucracy is too bloated and complicated to effectively administer these policies. Moreover, by imposing its will on the states, the federal government is diminishing the opportunity for experimentation and flexibility. Allowing for these would greatly enhance the effectiveness of the Great Society programs, as each state would be able to tailor funds towards its specific needs rather than adhere to a blanket method provided by the federal government. Indeed, the Great Society resulted in substantial “governmental fragmentation, inadequate coordination, growing intergovernmental conflict, and federal intrusiveness,” all of which hampered the administration of welfare policies (Conlan, 6). To avoid these problems, the role of the federal government in welfare policy must be reduced and delegated to the states, as they were before the Great Society.

The role of government in administering welfare programs not only should be restructured, but it also should be substantially reduced. Some economists such as Milton Friedman have argued for the implementation of a negative income tax, where people who earn below a certain amount receive supplemental income from the government rather than pay taxes and then  receive a welfare check. One of the War on Poverty’s fatal mistakes was in assuming the poor’s needs were primarily social instead of economic (Danziger, 7). The NIT would address this economic need while substantially reducing the government’s role in welfare programs, and, in theory, would eventually eliminate the need for welfare programs altogether, instead using the tax code to establish a social safety net. Compared to AFDC, NIT “provides recipients greater freedom of choice…does not interfere directly in labor markets, and has relatively modest…work disincentives,” a crucial factor in welfare’s long-term effectiveness (Danziger, 11). Through greater nationalization of income maintenance, the NIT creates “a more uniform, effective, and equitable welfare system” by decentralizing federal involvement in traditionally state and local initiatives such as community development (Conlan, 20-21).

receive a welfare check. One of the War on Poverty’s fatal mistakes was in assuming the poor’s needs were primarily social instead of economic (Danziger, 7). The NIT would address this economic need while substantially reducing the government’s role in welfare programs, and, in theory, would eventually eliminate the need for welfare programs altogether, instead using the tax code to establish a social safety net. Compared to AFDC, NIT “provides recipients greater freedom of choice…does not interfere directly in labor markets, and has relatively modest…work disincentives,” a crucial factor in welfare’s long-term effectiveness (Danziger, 11). Through greater nationalization of income maintenance, the NIT creates “a more uniform, effective, and equitable welfare system” by decentralizing federal involvement in traditionally state and local initiatives such as community development (Conlan, 20-21).

While an NIT would effectively reduce the role of government in welfare administration, it is imperative that this program also includes work incentives to avoid fostering a culture of welfare dependency. Without these incentives, the poor will become comfortable receiving a fixed income from the government, thus diminishing their motivation to seek employment and resulting in a continuous increase in the number of people on welfare. It is true that “the poor need support,” but the poor “also require structure” and inducements to become effective members of society (Mead, 22). By enacting limits and contingencies on welfare recipients, the poor would then be enabled, even enticed, “to achieve their long-run goals,” such as steady employment or a stable family life (Mead, 23). Enforcing certain productive values and targeting individual characteristics and incentives better motivates welfare recipients to seek employment and “integrates the seriously poor into the larger society” (Mead, 27-28).

The Great Society was correct in enacting a social safety net for America’s most vulnerable populations, but its methods and administration resulted in ineffective welfare programs and a bloated government bureaucracy. Intergovernmental relations need to be restructured, beginning with a reduction in the federal government’s role in welfare programs. This restructuring, coupled with work incentives and increased emphasis on personal responsibility, would create more effective policies in the long-term and reduce the number of welfare recipients. Indeed, welfare should no longer be considered a handout from the federal government, but rather a localized system that motivates individuals to become socially and economically responsible citizens.

Sources

Conlan, Timothy. From New Federalism to Devolution: Twenty-Five Years of Intergovernmental Reform. Washington, DC : The Brookings Institution, 1998. 1-35. Print.

Danziger, Sheldon. “Welfare Reform Policy from Nixon to Clinton: What Role for Social Science?”. Ann Arbor, Michigan: University of Michigan, 1998. Print.

Mead, Lawrence M. The New Paternalism: Supervisory Approaches to Poverty. Washington, DC: The Brookings Institution, 1997. 1-38. Print.